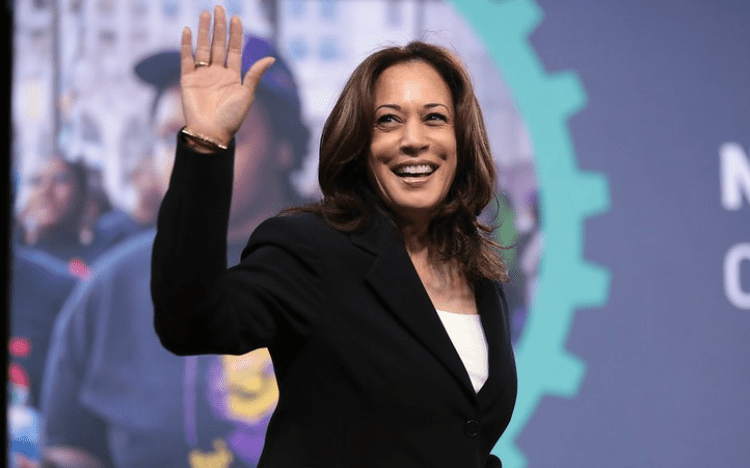

The U.S. presidential election, scheduled for November 5, 2024 (November 6, Thailand time), will be a contest between former President Donald Trump of the Republican Party and Vice President Kamala Harris from the Democratic Party. This pivotal election will likely influence economic policies and trade relations worldwide, including those with Thailand.

Potential Impact on Thailand’s Economy

Both major U.S. political parties, the Republicans and Democrats, have trade and investment policies that prioritize American interests, often leading to protective measures against foreign competition. However, the specific strategies and tools each candidate proposes vary significantly.

Donald Trump’s Approach, Trump has a history of implementing high tariffs on imported goods and may pursue an aggressive stance toward trade protectionism if re-elected. His policy proposal includes a substantial 60% tariff on Chinese imports and a 10% tariff on products from other countries. This broad-based tariff could disrupt global supply chains and hurt countries heavily reliant on exports, including Thailand. Thai exports to the U.S., a significant market, could become less competitive due to these heightened costs, impacting sectors like electronics, automotive, and agriculture.

Kamala Harris’s Approach, Harris, on the other hand, is likely to build on President Biden’s existing policies, which focus on selective trade restrictions rather than across-the-board tariffs. Her policies may limit foreign access to critical technologies and impose tariffs on specific categories of goods deemed essential to U.S. interests. For Thailand, this may mean more targeted tariffs and restrictions, particularly on technology and high-tech components. While less sweeping than Trump’s proposed measures, such policies could still challenge Thai exporters in sectors dependent on high-value manufacturing.

Broader Economic Concerns

In addition to tariffs, the regulatory environment could shift under either administration. Both Trump’s and Harris’s potential policies may prioritize domestic manufacturing and technological independence, which could lead to reduced U.S. demand for imports. For Thailand, these policies represent risks to export revenue, investment flows, and economic growth.

As Thailand considers its trade strategy, it will need to assess how to remain competitive in a potentially protectionist U.S. market. This may include diversifying trade partners, focusing on regional agreements, and investing in higher-value manufacturing to buffer against U.S. policy shifts.

Reference